It has been a busy year at Rogue Insight Capital. During the COVID-19 pandemic, we shifted our efforts to helping Canadians weather the crisis, and helping the federal government implement the right policies to mitigate the devastating financial impact this virus has had. Earlier this year, Reetu Gupta, Rogue’s Chief Strategy Officer, launched an initiative called Project: Kindness. Through this project, Reetu aimed to help those in need. Together with Suraj Gupta, Rogue’s CEO, Project: Kindness donated over 2000 pounds of food, 2500 medical masks, and a great deal of toiletries to shelters and hospitals across Canada. Further, Suraj has been advising the Federal Government of Canada and the Prime Minister’s Office throughout this pandemic on how to better enact legislation and financial support for hard-hit companies and industries with an objective of keeping as many Canadians on payroll as possible through the crisis. Many of Suraj’s suggestions have since become legislation, and a countless number of Canadian jobs have been retained through the pandemic thanks to the Government’s willingness to act.

While the pandemic has profoundly effected businesses around the world, many of Rogue’s portfolio companies have thrived through this difficult period. Below, we have highlighted a few of these investments.

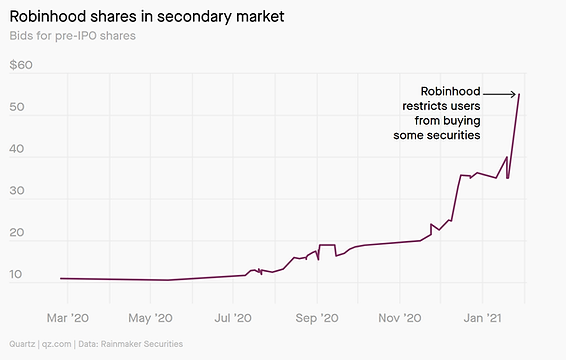

Robinhood

Robinhood, the stock-trading app that has democratized market access, has had a very controversial year to say the least. Some unprecedented market volatility led Robinhood to restrict trading on certain equities (namely Gamestop), and this led to a large degree of negative publicity. However, they have grown at a meteoric pace as retail investors have been scrambling to open trading accounts. In 2016, Robinhood is reported to have had 1 million users, and today they have over 13 million. Further, the secondary market has reportedly valued Robinhood shares 5x higher than one year ago. Robinhood filed paperwork with the SEC to IPO later this year, and this will be one of the most talked about IPOs of 2021.

Oaktree

In November 2019, we recognized that a recession was inevitable, as markets had long been moving in an unsustainable direction. Recessions tend to present unique investment opportunities to those who are willing to capitalize on them, and this past year was no different. Rogue partnered with Oaktree, a world-renowned firm founded by Howard Marks, to invest in displaced and distressed European companies at excellent entry valuations and positioning them for long-term success. This strategy invests across the EU and the UK, including real estate, infrastructure, and even a Ligue 2 Football team.

Real Estate Investment Trusts (REITs)

We also took advantage of incorrect public market pricing during the pandemic. REITs tend to trade at a discount to their net asset value in public listing. However, during the March 2020 market downturn, some of these discounts hit egregious levels. Many REITs were trading as low as 25% of their asset value. We made several investments across this space and realized IRRs over 250% on our exits.

Chatter Research

Chatter Research is a Toronto-based AI platform used by consumer facing brands to have better, more insightful conversations with their customers. The Chatter team is incredibly talented, and the company was acquired by Stingray Media in Q1 2020. The team will continue to build out the Chatter product under Stingray’s prevue. Congratulations to the Chatter Research team!

Pyrowave

Pyrowave is a Montreal-based CleanTech firm that is tackling polystyrene (Styrofoam recycling). Styrofoam presents a significant environmental problem, as any Styrofoam produced comes with a one-way ticket to a landfill, and there are enough Styrofoam cups produced daily to circle the earth. Pyrowave has fixed this, by building the world’s first technology that can recycle and reuse polystyrene. Pyrowave raised a significant funding round led by Michelin, who will be using Pyrowave’s recycled styrene for their Formula E tire production. Pyrowave is poised for immense growth and will significantly reduce our carbon footprint on this planet.

Marble

One of our first ever investments was in Marble, a start-up focused on developing autonomous technology for last mile delivery. Marble’s brilliant technology has been used by several, large delivery companies including Yelp and DoorDash, and the firm was acquired by Caterpillar earlier this year. Congratulations to the Marble team!

Pershing Square Tontine Holdings (PSTH)

We partnered with globally renowned investor Bill Ackman to invest in Pershing Square’s latest SPAC (Special Purpose Acquisition Company). SPAC’s simplify the IPO process, as they raise money from investors in a vehicle that goes public, then use this money to acquire a private company. This effectively allows a private company to go public overnight, in a much simpler process than a typical IPO. Mr. Ackman and the Pershing Square team have created a significantly better model for SPAC’s through PSTH, and we entered our position at the IPO price of $20. We have since partially exited near $30 while we await the target company announcement.

Wine.com

Wine.com is the market leader in wine delivery in the USA, and they had a record year in 2020. With a subscription program offering free delivery on wines for an annual fee, an incredible selection of inventory, and a team of sommeliers available to assist customers with their purchases, Wine.com more than doubled revenue to well over $300 million last year. They are well-positioned to IPO before 2023.

Borrowell

Another great Canadian FinTech, Borrowell, provides Canadians with free credit scores and recommendations on how to improve their credit. Borrowell has assisted millions of Canadians with improving their financial situation, and they recently raised a large up-round and acquired Refresh Financial to increase their product offerings. Congratulations to the Borrowell team!

WeWork Property Investors

In 2018, we had the opportunity to invest in WeWork. At that time, WeWork was one of the world’s hottest unicorns and was worth $47 billion. We passed on this investment, as we felt this lofty valuation had too much downside despite the excitement. However, we saw incredible value in the real estate that WeWork was leasing, as the firm often brought a ‘cool factor’ to the neighbourhood alongside some great, new tenants. We partnered with WeWork to begin purchasing this underlying real estate around the world. Since 2018, this portfolio of real estate has increased significantly in value (despite the pandemic hitting the office market hard), while WeWork’s equity valuation dropped from $47 billion to $8 billion. Needless to say, we made the right choice!

We are grateful to have had a fantastic year despite the turmoil in the world. Further, we have added some incredible portfolio companies that we are excited to disclose as soon as confidentiality allows. As always, if you have any questions, feel free to contact us at [email protected]. Stay safe, and thank you for reading!